How ESG helps supply chain assurance companies with commercial performance

9 September 2022

Share this article

Environmental, social and governance (ESG) concerns deliver positive commercial performance

A company’s environmental, social, and governance (ESG) proposition often starts with reacting to new or emerging regulations, or to retaining a social license to operate in the face of external forces. It can be viewed as a way of mitigating risk and demonstrating compliance with sustainability best practices.

ESG’s primary benefit in the era of carbon reduction and social transformation, however, is not in risk mitigation, but in its role as a value creator.

A strong ESG proposition makes financial sense whether it is through enabling top-line growth, cost savings, reducing regulatory and legal interventions, improving productivity, and optimizing investment and capital expenditures.

Cost Savings

ESG policies can clearly generate cost savings from lower energy consumption or reduced water use. However, it can also help to mitigate against rising operating expenses for raw materials. Switching to more sustainable methods of production can be more efficient with reduced waste. For example, shifting away from the use of virgin plastic packaging to food-grade recycled plastics or other types of sustainable packaging solutions can deliver savings from non-compliance costs among different geographies where stricter laws relate to the use of plastic packaging. Consider Unilever, which has realized over $2.1 billion through sustainable sourcing efficiency improvements since 2008.

A leading dairy company in Europe has implemented various strategies and schemes for reducing GHG with the aim of making the company carbon neutral, including a circular strategy for packaging, and producing green electricity. The company is constantly working towards cost-saving measures which are in alignment with achieving sustainability. This has led to the revenue growth of the company. The loans given to the company are incentivized by discounting the interest rate but only if the company achieves the desired sustainability targets.

Reduced regulatory and legal interventions

ESG-related regulation is emerging rapidly. In recent years, ESG regulations have gained the greatest momentum in Europe, while the USA has recently signed a historic climate and tax bill which pledges US$369 billion in climate investments over the next decade.

In March 2022, the US Securities and Exchange Commission (SEC) proposed rule changes that will require the disclosure of climate-related risks and opportunities. These amendments will apply to public companies in the USA and any foreign issuers listed in the US.

A strong external ESG proposition can reduce companies’ risk of adverse government action, and even engender government support.

Businesses will also be in an advantageous position to benefit from grants and tax credits. The US climate bill will provide $60 billion in grants and tax credits for clean-energy investments and projects to clean up pollution in disadvantaged communities. It will also award $128 billion in tax credits over the next decade for businesses shifting to greener power sources, such as solar, with billions for decarbonization, clean-vehicle purchases and efficiency improvements.

Increase Employee productivity

Evidence shows that businesses with strong ESG policies attract and retain talent, enjoy more motivated staff and an improved corporate culture, and achieve higher levels of productivity.

A recent study, Benchmark of Ethical Culture by LRN, which surveyed 8,000 employees across 17 industries, found that companies with the strongest ESG propositions outperform others by 40% across a number of business metrics including levels of customer satisfaction, employee loyalty, innovation, adaptability and growth.

It reported that 94% of employees say it is "critical" or "important" that the company they work for is ethical. 82% said they would prefer to be paid less but work for a company with ethical business practices than receive higher pay at a company with questionable ethics. 80% cite disagreement with the ethics of fellow employees, a supervisor or management as the most important ethical reason for leaving a job.

Optimizing investment and capital expenditures

According to Ultimus Fund Solutions, investments in ESG strategies grew 42% from 2018 to 2020. Currently, one of every three dollars of assets under management is invested in ESG strategies.

While investments to update equipment and manufacturing plants operations may be significant, businesses that continue to operate from energy inefficient plants may find it a more expensive option in the long-term. In addition, future limitations or bans on things such as the use of certain types of packaging to diesel-fuelled transport will impose future costs on business.

Funding options presented by the US climate bill or China’s promise to create more than $3 trillion in investment opportunities through to 2030 in clean energy initiatives and decarbonisation are available for businesses that act now.

Investments in ESG strategies grew 42% from 2018 to 2020

Current Issues

Despite the opportunities to create value, there are barriers preventing businesses from developing a strong ESG proposition.

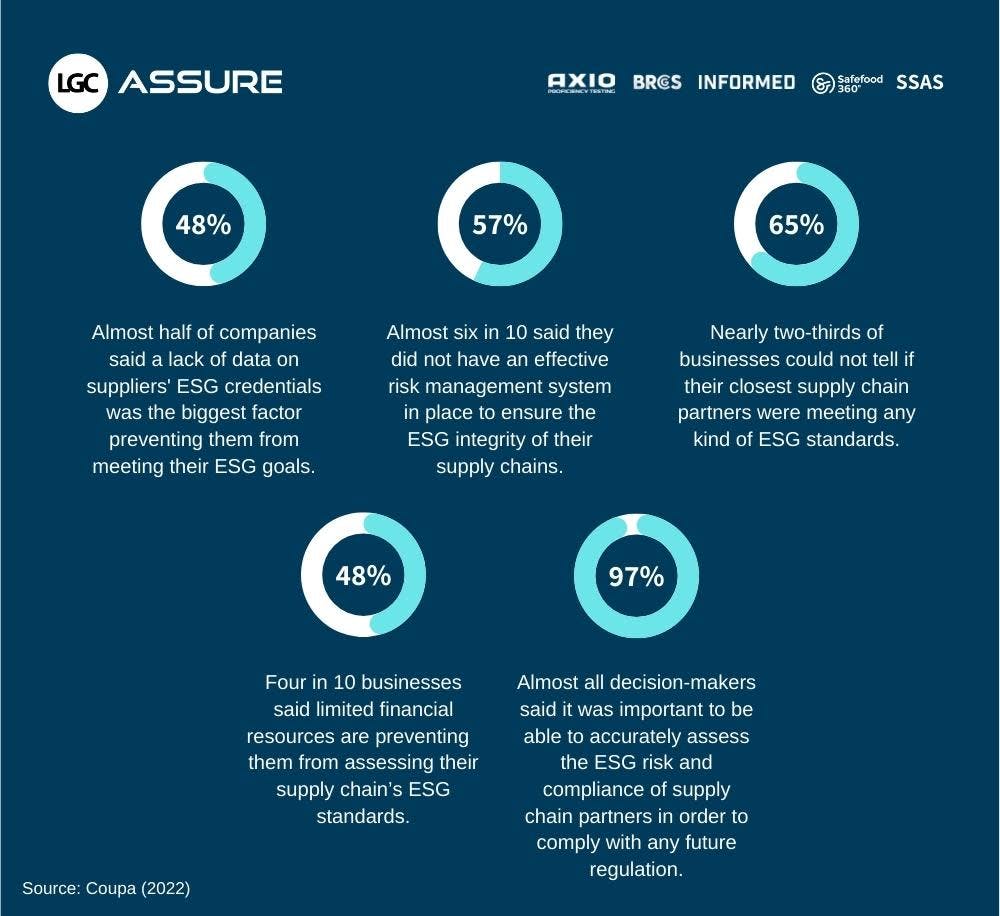

Research by Coupa published this month reported that almost half (48%) of companies said a lack of data on suppliers’ ESG credentials was the biggest factor preventing them from meeting their ESG goals.

They found nearly two-thirds (65%) of businesses could not tell if their closest supply chain partners were meeting any kind of ESG standards. Almost six in 10 (57%) said they did not have an effective risk management system in place to ensure the ESG integrity of their supply chains.

Almost all decision-makers said it was important to be able to accurately assess the ESG risk and compliance of supply chain partners in order to comply with any future regulation.

While large businesses could afford to have dedicated teams to look after their ESG measures and benefit from them, small businesses can benefit from faster decision making, flexibility and closer contact with their customers which helps them better understand their needs.

Share this article