Food operators must improve ESG reporting to satisfy brands and regulators

Changing ESG regulation will result in changes to the way food operators disclose and promote environmental claims and reporting.

9 December 2022

Share this article

Regulators are focusing on the environmental impact of food producers

In the last month alone, government regulations are emerging that will impact on food manufacturers. The EU has unveiled rules requiring all packaging materials to be recyclable by 2030. It has also tabled new ESG labelling rules to mitigate greenwashing accusations and litigation risks.

The Corporate Sustainability Reporting Directive will require companies to provide sustainability disclosures and their impacts on the environment, human rights and social standards and sustainability-related risk.

Further to this, the EU announced an agreement on regulations supporting deforestation-free supply chains, aimed at ensuring that products imported to or exported from EU markets no longer contribute to deforestation and forest degradation globally.

The Swiss Government has adopted mandatory climate reporting, and a UK regulator has set out plans to develop a code of conduct for ESG ratings and data providers.

Some Brands are following suit and taking proactive steps. Ahold Delhaize confirmed that it will ask its suppliers to report their ESG-related performance and to set science-based climate targets by 2025. While PepsiCo announced a new goal to double the proportion of beverage servings provided in reusable or refillable packaging to 20%, from 10% currently, by 2030.

The problem of reporting emissions for food manufacturers

As described above, regulators and brands are focussing in on ESG. But food manufacturers are struggling to keep up with the demands of reporting.

For example, the bulk of a typical food manufacturer’s emissions are defined as Scope 3 emissions, which include all other indirect emissions that occur in a company’s value chain. They can typically account for 90-95% of a food manufacturer’s emissions. However, they can be difficult to calculate and, therefore challenging to address and improve.

Ignacio Gavilan, sustainability director at The Consumer Goods Forum stated in an article ‘The challenges facing food manufacturers on Scope 3 emissions’ that Members have significant concerns about Scope 3. It is something that was not given proper attention until the last 18 months but has rapidly escalated more recently.

Data published by the World Benchmarking Alliance, which ranked the 350 largest food and agriculture companies, showed at the time that only 26 of the world’s largest food and agriculture companies were working to reduce their Scope 1 and 2 greenhouse gas emissions. While only seven had a time-bound target to reduce Scope 3 emissions.

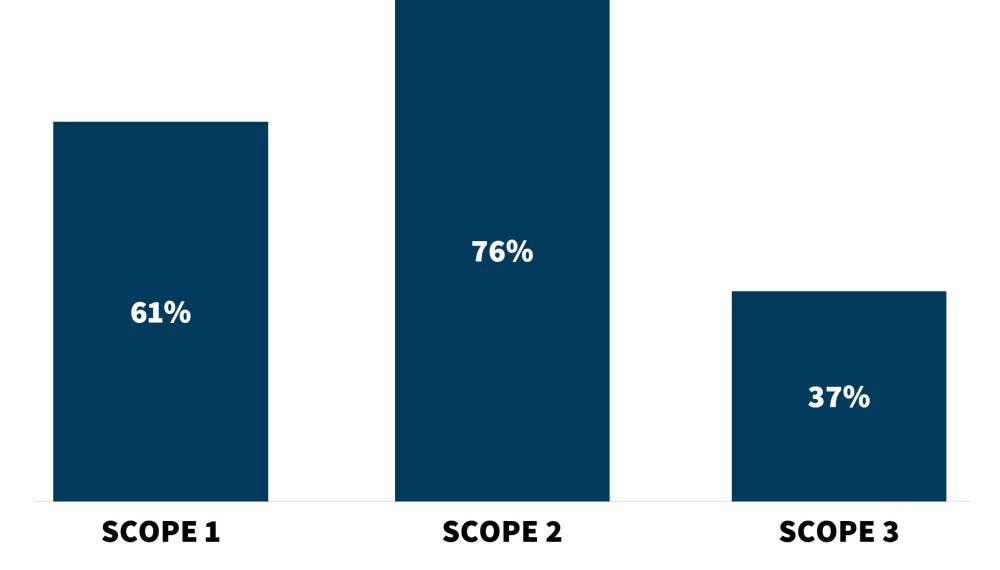

An industry-wide report published by Deloitte this month, paints a similar picture. While 76% of senior executives report that they are prepared to disclose their Scope 2 emissions, only 37% are in a position to report on Scope 3.

More than a third of senior executives cite data quality as the reason for their unwillingness to disclose, while 25% cite access to the data as their biggest ESG challenge.

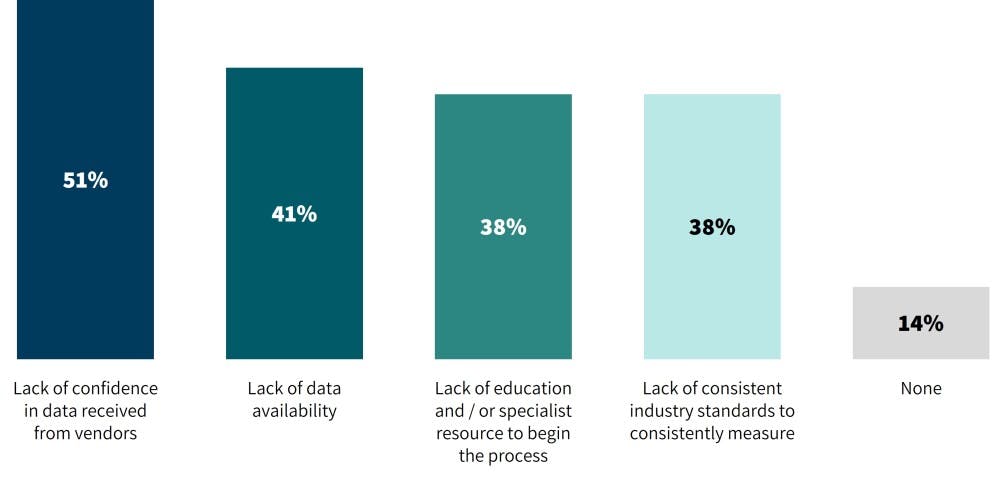

Drilling into this issue further, 86% of respondents indicate they’ve encountered challenges measuring Scope 3 GHG emissions. The main reasons cited are the unavailability of data, ana a lack of confidence in vendor data that is provided to them.

ESG capability needs to be available for all types of food manufacturers

ESG issues are placing increasing pressures on brands in terms of regulatory compliance and reputational protection. While there is a growing number of regulation covering E,S and G, frameworks remain immature and can vary significantly between economies. The ESG market, whether consultancies, ratings agencies, data providers or solutions providers, is crowded with new entrants emerging all the time. The majority of food business operators do not have the expertise or dedicated ESG personnel to meet these demands. BRCGS however believes ESG progress need not be dependent on internal resource availability.

PepsiCo to increase reusable or refillable packaging from 10% to 20% by 2030

ESG reporting is needed to satisfy demands from regulators and brands

Importantly, the crux of the problem lies in the inability of current systems to accurately verify the steps that suppliers are going to take to improve their ESG performance. With supply chains accounting for very large proportions of a brand’s sustainability footprint, responsible sourcing is a major source of cost-saving, ESG improvement and reputational enhancement.

Share this article